How Jeff Bezos Built a 1.8 Trillion Dollar Company

Lessons from his 1997 Shareholder Letter

Welcome to the 133 people who have joined the community since my last post. If you haven’t yet subscribed, join 5,619 lifelong learners here:

In 1997, Jeff Bezos set out his vision for Amazon in his first shareholder letter which stated his preference for long-term thinking, bold investment decisions, and a ruthless priority for gaining market leadership. With the asymmetrical opportunities that e-commerce offered, Bezos would fundamentally reverse standard business practices and come to dominate online selling.

Here are 7 business principles I learned from reading about Jeff Bezos’ philosophy.

Be An Architect of Long-Term Thinking

“We believe that a fundamental measure of our success will be the shareholder value we create over the long term. Because of our emphasis on the long term, we may make decisions and weigh tradeoffs differently than some companies.”

From the get-go, Bezos fired warning shots to those on Wall Street: We will pay no attention to short-term profitability. Amazon's success would come from playing the long game and not thinking about quarterly profits. Bezos's core goal was growth, and his calculated bet on digital economics would pay dividends. With this emphasis on long-term thinking, Bezos was setting a precedent for the type of shareholder he valued- those with ambition, imagination and stomach. Bezos would turn Amazon not just into a successful company, but a self-reinforcing giant.

Over the years Amazon would fail many times with new products and features but Bezos always thought in different time dimensions to others. He knew when to cut what wasn’t working, but he also when to let things grow. Shifting your perspective from days and months to years and decades will naturally allow the seeds you’ve sown to grow and mature. They won’t all turn out to be oak trees but every once in a while, one will.

The Amazon Flywheel

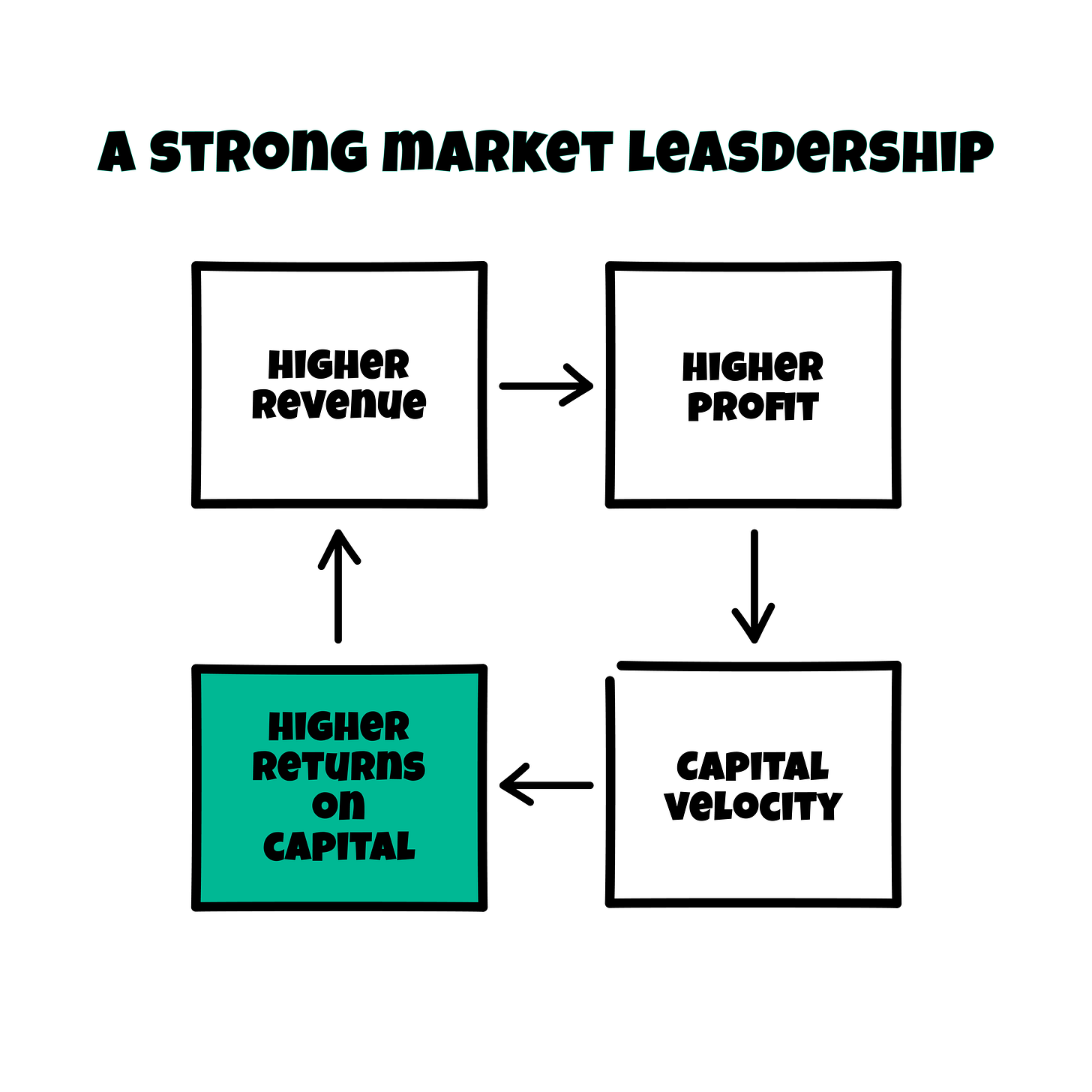

“The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital. At this stage, we choose to prioritise growth because we believe that scale is central to achieving the potential of our business model.”

The Amazon flywheel concept represents perhaps Bezos' most explicit application of systems thinking. The rapid service, endless optionality and bargain basement prices serve to fit into its gigantic reinforcing feedback loop which leaves people, merchants and businesses relying on them more and more. Understanding and curating their flywheel wasn’t easy, was costly and timely but boy was it worth it. Many businesses have poorly constructed or weak flywheels if indeed they are one at all but understanding what yours is, is crucial if you not only want to survive but thrive.

When Bezos encouraged merchants to compete with Amazon on their website through Marketplace many thought it was ridiculous and most costly, but Bezos didn't see it that way. The positive feedback loop he created by allowing merchants to make money on his website was soon replaced by something else, a toll bridge. Once merchants were reliant on Amazon for sales he ruthlessly made them pay to be seen when he introduced PPC (Pay-per-click)) advertising and in 2024 roughly 25% of Amazon’s revenue came from third-party sellers. The infrastructure that Amazon needed to accelerate growth was being paid for by the people who relied on it most.

Create Compounding Systems

“We will continue to measure our programs and the effectiveness of our investments analytically, to jettison those that do not provide acceptable returns, and to step up our investment in those that work best. We will continue to learn from both our successes and our failures We will make bold rather than timid investment decisions where we see a sufficient probability of gaining market leadership advantages. Some of these investments will pay off, others will not, and we will have learned another valuable lesson in either case.”

Amazon Prime, AWS, Kindle and Marketplace were considered risky investments at the time but have all gone on the be hallmark features and products of Amazon. Bezos's commitment to gaining market share may have come at the expense of short-term profits but these bets don't pay off linearly, they pay off exponentially. There have been many failures along the way such as Amazon auctions, an attempt to subjugate eBay, and the Fire phone are but two. Bezos clearly understood that you should only bet what you're willing to lose knowing that the result from winning isn't just a home run, but a championship.

Not all your ideas will turn out great and failure will happen more times than success, but to quote a heavily overused sports cliché: “You miss 100% of the shots you don’t take.”

Never Forget: It’s Always Day 1 for Your Business

“We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.”

Bezos was obsessed with the concept of “day 1” thinking right up until his departure as CEO. Repeatedly asked by employees and outside sources what day 2 looked like Bezos went so far as to name his 2016 shareholder letter “Fending Off Day 2.” For Bezos, day 2 represented a static-like quality and the subsequent slow decline of Amazon’s empire– something Bezos would not entertain as he vigilantly rebuffed any attempt to forget his gospel.

Day 1 wasn’t just the best way at Amazon; it was the only way.

Businesses that move from day 1 thinking to day 2 eventually die. Sure, companies can and do mature but to stop innovating is a death sentence and many companies that were once giants have ended up in the capitalist wasteland. Borrowing from Nike founder Phil Knight “You grow or die.”

Capital Allocation, Capital Allocation, Capital Allocation.

“When forced to choose between optimising the appearance of our GAAP accounting and maximising the present value of future cash flows, we'll take the cash flows.”

Companies with cash will always have investment opportunities, such as attracting highly capable people, tangible or intangible assets, infrastructure and R&D. Companies that just make a profit don’t. Amazon was swimming with cash, and one of the most important jobs of any CEO, founder or manager is capital allocation. Understanding how you’re going to turn $1 into $1.10, into $1.25, into $1.70 etc means killing as many good ideas as the ones you follow through with. Time is one thing we haven’t yet managed to accumulate more of.

For businesses cash truly is king and although carrying physical cash is becoming a bit of an inconvenience, cash in the bank is different. It empowers leaders and paves the way for new opportunities. Profits are great and all but you can’t spend profit like you can spend cash, and you can’t spend profit on investments to future-proof the company or give it away to shareholders if that profit isn’t converted into free cash flow.

The Integrated Customer System

“We will continue to focus relentlessly on our customers.”

Bezos orientated his entire philosophical reference point around one thing; the customer. He was fanatic about giving customers the best value and best service, often, and especially at the start, at the expense of Amazon's bottom line. By having the customer as his north star Bezos and his team often thought from the customer's perspective and worked backwards to implement the best features products and services. But, Bezos being Bezos went a step further. He created products and services when the customers didn't even know they needed them. Nobody asked for AWS but now millions of companies globally rely on it to run their businesses, including Fortune 500 companies. Nobody asked for Amazon Prime either, but now it's estimated that 200-220 million people globally rely on it to deliver their products to their door within 24 hours at rock-bottom prices.

Amazon relied on an insurmountable amount of data to reverse engineer customers’ behaviour on their websites so that they could build systems that made customers more inclined to buy from them. Figuring this out was painful for them and it’s why most companies incorrectly make a product first, and later find a market for it to fit into, but that wasn’t and still isn’t the Amazon way.

Bezos didn't succumb (often) to competitive pressures but by aligning Amazon to the customer’s needs, desires and wants he's turned those same people into Amazon junkies, reliant on a quick e-commerce fix, delivered at rapid speed to their doorstep.

A Players Only, Please

“We know our success will be largely affected by our ability to attract and retain a motivated employee base, each of whom must think like, and therefore must actually be, an owner. We will continue to focus on hiring and retaining versatile and talented employees, and continue to weigh their compensation to stock options rather than cash.”

Bezos's philosophy and working demands are infamous and aren't for everyone but Bezos echoes what many other great innovators such as Steve Jobs and Elon Musk have said in one way or another: When hiring, nothing less than A-class players will do. They believe that if you higher B players they lower the bar, and C players even further. When Bezos needed to lay people off he didn't announce ‘layoffs,’ he ruthlessly gamified the process and got rid of people who didn't meet the bar.

“I ask people to visualize the company 5 years from now. At that point, each of us should look around and say, “The standards are so high now -- boy, I’m glad I got in when I did!”

Through fear and incentives, Bezos looked to plug a hole in every company’s sinking ship- The Principal-Agent problem. Whatever the company, if you have more agents than principals, at some point, the ship will sink. A-class players, aligned with your company philosophy, create formidable employees and where B-class agents eventually sink the ship, A-class principals build the ship, the Navy and control the 7 seas.

Final Thoughts: The Emergent Giant

“We aren't so bold as to claim that the above is the 'right' investment philosophy, but it's ours, and we would be remiss if we weren't clear in the approach we have taken and will continue to take.”

- Jeff Bezos

People are funny. While writing this piece there has been an Amazon boycott mostly in the States by, from what I can tell, people who are politically aligned to the left. I have no interest in American politics and find it fascinating that over the last 28 years, Amazon has given people exactly what they wanted; cheap goods and services, delivered straight to their doorstep or device from a single click.

People should be careful what they ask for.

If what you seek is something different then go build it. If you think you can’t or don’t have the resources, try to wrap your head around how somebody could go from selling books from his garage to running a company that is projected to turn over $700 billion this year, is valued a 1.8 trillion dollars, who went from 1 to over 1.6 million employees, and from serving people from his garage to serving people globally.

It’s nearly 30 years since Bezos wrote his first shareholder letter and it’s glaringly obvious he was never going to allow room for anybody else. Even better, he gave anybody willing to listen a head start on what and how he was going to do it.

Until next time, Karl (The School of Knowledge).

Whenever you’re ready

The School of Knowledge helps you understand the world through practitioners. Those who try, fail and do (skin in the game). 📚💡

Join our growing community of 5,619 lifelong learners here:

Very well done!

Interesting. Systems can be designed for many different things . .