How Understanding Probability Can Make You Rich

A lesson from the Nomad Letters

“I have pointed out that any superior record which we might accomplish should not be expected to be evidenced by a relatively constant advantage in performance compared to the average. Rather it is likely that if such an advantage is achieved, it will be through better-than-average performance in stable or declining markets and average, or perhaps poorer-than-average performance in rising markets”.

- Warren Buffet, 1960 Buffet Partnership letter to investors

How well do you know probability? Let’s play a game to find out.

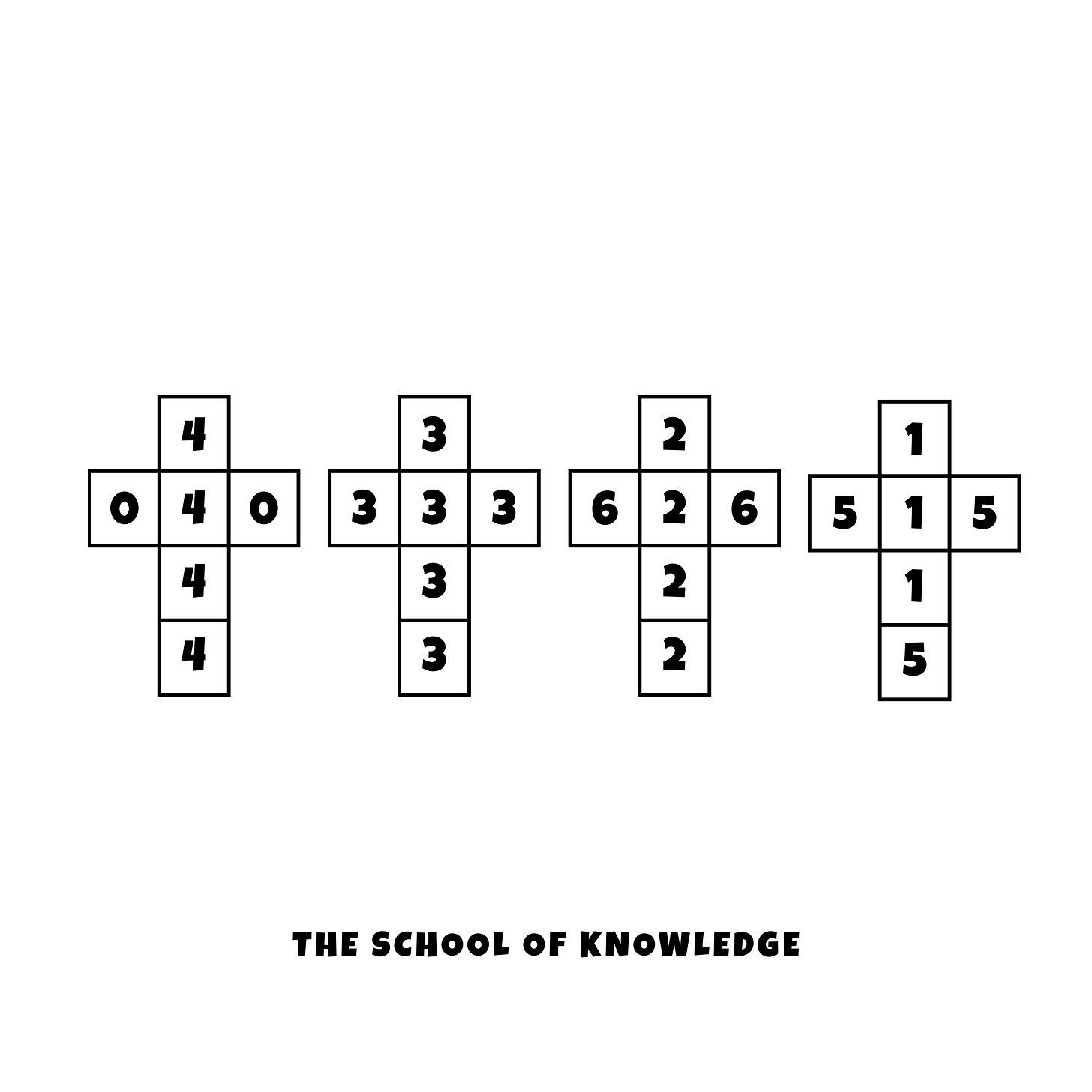

The game involves magic dice and as I’m the host, I invite you to choose your dice from the diagram below and then I pick one after you. You get to roll first and it’s the best out of 10.

For fun, let me know which dice you picked below.

Before we play the game, let's discuss the four options available.

Naturally, when playing a game you will want to win so you may have discounted the dice with zeros in as surely they offer no value. The higher numbers of five and six will surely on average beat the lower dice numbers of three and four, right? But, as you may have observed the higher frequency numbers are inconsistent compared to the lower frequency numbers that are more consistent. Perhaps, you added up all the numbers and went with the highest total number?

I’m afraid to say that whatever dice you choose, I will still win. Before this disappoints you and you storm away, stick around to see how this can be used to your advantage in investing.

My understanding of probability isn’t great. So much so that from now until the end of the year it is going to be a little project of mine to better understand it. In doing so I will share what I learn with you (be patient and gentle with me as I learn,) and ask for recommendations for books, articles or papers to help me.

Back to the explanation.

I’ve been reading Nick Sleeps Nomad Letters for the last couple of weeks thanks to a recommendation from Taylor Dean-Lipson who writes The Daily Spark, where he discusses non-transitive sequences. Logically, we believe that a > b and b > c, and that a is also > c. This is a transitive sequence and as Nick Sleep says “is deeply embedded in our mental problem-solving apparatus.”

“As displayed in the diagram above, the dice on the left beats the dice on its right, and so across the diagram, but the dice on the far right also beats the dice on the far left!”

By letting my opponent choose first I must correctly assess the probability and frequency of the remaining dice knowing that each selection can beat another. Remember, it’s about picking a superior dice on average (over 10 games).

The trick is in letting your opponent pick the dice first and as a consequence revealing some information that you can use against them. If it was a concealed choice my odds would reduce.

This is where we can gain an edge in investing:

“Non-transitive dice offer two handy investment models: first, just as any dice can win for a while, so any superiority an investment process may have will only emerge with time, so patience is important. Second, the stock market posts prices every day, this is the equivalent of making your opponent choose his dice first. The prices the market sets reveal information about a company’s prospects which may or may not provide an opportunity, it is up to investors to either take the market up on its offer or wait for another price, another day.”

The second model is the most interesting to me. Every day the market offers me a price on stocks I’m interested in and most days I’ll say, “No thanks, that’s a bit too much for me,” but now and again I know that the market (people) will be irrational. So long as I’ve done my due diligence these (albeit a minority) offerings are where you can win, and win BIG.

They say that first movers get an advantage and that may be so, but not all the time.

Until next time,

Karl (The School of Knowledge)

Whenever you’re ready

The School of Knowledge helps entrepreneurs and professionals convert worldly wisdom from books into actionable insights📚💡

Consider joining our growing community of like-minded life-long learners.

Thanks for the shout-out, Karl!

Buffett used to pull that dice trick on a lot of people, but my favorite story is when he tried it on Bill Gates. Trying to seem polite, Buffett offered Gates the first pick of the dice. But after a quick inspection, Gates insisted Buffett go first instead. That's when Buffett knew—Gates was one of the few sharp enough to catch on to the trick lol

Nice Karl